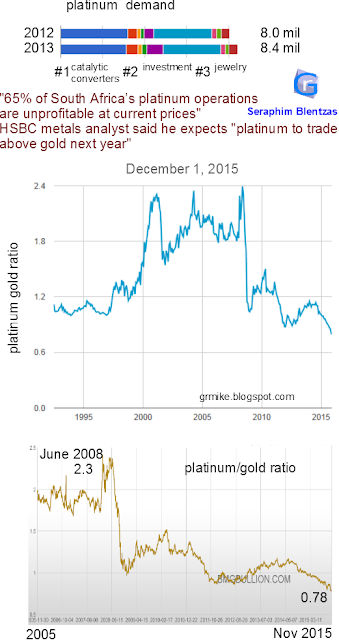

But industry demand remains strong having eclipsed eight million ounces last year for just the second time in history, and with South Africa being home to 95% of global reserves, production issues in the country will swing supply/demand in the wrong direction in upcoming years.

Demand - platinum is more widely used industrially (catalytic/automotive as well as laboratory equipment)

Supply - depends more on recycling than any other metal - 2.1 vs 5.7 million ounces (total demand ~ 8M ounces per year). But there are concerns over production - demand for platinum is known to fall during times of economic uncertainty which is more true today than at any other time in past fifty years. Volkswagen diesel scandal is also weighing down prices - diesel vehicles may not be as popular in the future meaning less demand for catalytic converters - which account for 40% of platinum demand.

Just last month an HSBC metals analyst said he expects "platinum to trade above gold next year" A discounted platinum price will boost jewelry demand allowing it to take market share away from gold.

Analysts see platinum at $1150 in 2016, $1300 in 2018.

No comments:

Post a Comment