- Toyota using palladium in place of platinum in catalytic converters,

- Palladium was less affected by the problems in South Africa

- Lower Russian output. The price ratio could increase even more in the future because supplies haven't been tight as compared to alternatives platinum and rhodium.

- According to some analysts, there was a platinum overproduction of half a million ounces in 2012.

Norilsk Nickel nilsy is the world's largest nickel producer and ranks among the top five companies in terms of platinum reserves. The company operates in Russia, Finland, Botswana, South Africa and Australia. The Norilsk deposit in Russia was among the first exploited platinum deposits.

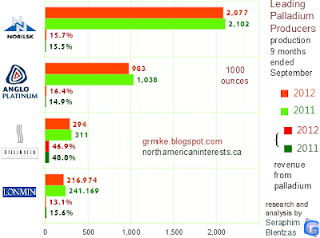

From January to September 2012 Norilsk produced 2.077 million ounces of palladium, down 1.2% from 2011. Russia was the source of 96.1% or 1.996 million ounces.

In interim 2012 the company earned $1.481 billion (-22.0% from $1.818b) on revenues of $5.929 billion (-19.2% from $7.335 billion). Revenue attributable to palladium: 1h2012 15.7% (1h2011 15.5%).

Anglo American Platinum pink:agppy - Palladium production down for the nine month period but up 4.3% in the 3rd quarter (376k oz -> 392k oz). Sales of platinum group metals: 3275 million ounces (-7.45% from 3535m oz).

Prices achived: Platinum $1513 (-14.8%), Palladium $637 (-17.4%), Rhodium $1304 (-39.3%), Nickel $17,159 (-30.1%). Cash operating costs per ounce of platinum produced: R14,976 +14.4%. Unki production +20% year on year. An illegal mine strike cost the company 2,000 oz of platinum output in the third quarter.

Biggest contributor to revenue is the Mogalakwena Mine. Mogalakwena contributed 24.8% of six month revenue came from the mine (-8.6%). 9m2012: $983,000 down from $1,038,000 in 2011.

% revenue from palladium: 16.4% down from 14.9% last year.

Stillwater Mining Company nyse:swc, tsx:swc

- Has a three year agreement with General Motors Corporation for a monthly delivery of a fixed amount of platinum group metals (platinum, palladium, rhodium) which is set to expire at the end of 2013.

- one year agreement with Tiffany & Co expires end of 2012.

- Supply agreement with Johnson Matthey.

- Year to year agreement with Ford Motor Company.

- No outstanding derivative contracts

- one of only two platinum/palladium companies based in North America (other one is Canadian mining company North American Palladium)

% revenue from palladium: 46.9% down from 48.8%.

Lonmin lon:lmi

Fiscal year ends September 30. It's the 3rd largest producer of platinum in the world. All of its mines are located in the Bushveld Complex of South Africa. Production in the three months ended September 30, 2012 was down 45.7% due to a mine strike (-110,000 oz), however refined platinum was down only 20.8% due to stockpile usage.

9 months to Sept 2012: 216,974 oz -10.0%.

% revenue from palladium: 13.1% (15.6%). fiscal 2012

Fiscal year 2012 revenue: $1.614 billion -18.98% ($1.992b),

Total PGM sales: 1383.945 k ounces down -3.6% from 1435.929 koz the year before.

informative

ReplyDeletethanks ! next post in April or May 2014 will include data updated for 2013. also, how the Russian Crisis could affect the supply side this year and next.

Delete